2023 Q3 Client Letter

To the Clients of Resilient Asset Management:

Greetings from world headquarters in Memphis. What was a very hot Summer in Memphis has somewhat turned to Fall. The school year is well underway and on we go with life.

For financial matters, as is typical, the media reports seemingly pure carnage with several flavors of doom on the horizon. Less well-advertised is what used to be on the backpages of the newspaper and is now the smaller font portions of the webpage: Not all the doomsaying predictions turn out to be as bad as they seemed.

Using a now old-fashioned search engine, you can easily find credible sources that predicted both mass worldwide famine and London being overcome by horse excrement. Happily, neither prediction came to fruition. This cycle repeats itself over and over and over. I would be dead broke if I had to make a living making predictions.

The Doom Flavor du jour is recession. Will we have one? Are we in one? Will we have a soft landing, a hard landing, or even no landing? These questions are incessantly pondered by well-meaning, well-read, well-intended people. Unfortunately, these same people apparently don't read the published research about the utility of economic forecasts.

You can read one such article here: HOW WELL DO ECONOMISTS FORECAST RECESSIONS

Adding to this thread, I recently read a periodical documenting the Federal Reserve Board Members' December 2021 predictions of where interest rates would be one calendar year forward, in December, 2022. The consensus prediction was a move from 0% to just below 1%.

Before I remind you of the answer, you should note that the Federal Reserve Board SETS INTEREST RATES. And the Board Members are some of the most knowledgeable economic people around with access to nearly unlimited data.

The actual prevailing interest rate in December, 2022 was 4.5%...at least they got the direction right, though which other way could you go from 0%.

So if the Federal Reserve Board can be so far off on projecting the rate they set themselves, I would caution you from investing any faith in ANY economic prediction. In most cases, a prediction reveals much about the prognosticator....THOUGH NOTHING ABOUT THE FUTURE.

While I have no opinion about when the next recession will arrive - trust me, one will at SOME point in the future - I can say that if one occurs in the near-term, it will be the most predicted recession I can recall. And as some of my friends remind me each August, the repository from which I can recall such events has grown....albeit only somewhat.

Whether a recession happens in 2023 or 2024, it's pretty safe to assume markets have acknowledged the possibility and prices probably somewhat reflect an economic slowdown of some sort.

Remember, financial calamities are not limited to recessions. For example, in December 2019, despite COVID being somewhat well-reported in the media, few were liquidating equity portfolios in anticipation of the coming gloom. Similarly, in December of 2021, few prognosticators were recommending liquidating fixed-income portfolios in anticipation of rapid interest rate increases. What's also important to note is that the next calamity to come upon us is likely to be something very few people are talking about...the two situations above exemplify this thought.

So rather than be in the business of economic predictions, I'd suggest you'd be better off to focus your efforts on constructing a Gibraltar-like financial posture. Specifically, if you acknowledge that the utility of economic predictions is of limited value, you can focus your attention on the resiliency of your financial circumstances. How does one do that?

Well, it's the same bedrock financial principles you have heard from me time and time again....control those matters over which you have direct influence:

- Have a cogent and current estate plan

- Insure against the risks that could bring calamity to your life

- Be current on your Income Taxes with sufficient liquidity for taxes due

- Spend less than you make and have a savings rate commensurate with your financial goals

- Think long-term about your investments and don't obsess over 1-Year Performance

To sum up this financial philosophy in one phrase: "Rather than trying to predict floods, build financial arcs."

Does doing all these things absolutely insulate you from financial difficulties? Of course not. The nature of our capitalist system tends toward periods of over-abundance and subsequent periods of hardship. The more you accept this reality and the more firmly you embrace the principles outlined above, the better-armed you will be to navigate the wavy economic patterns lying ahead.

Foreign Investments

Investment Performance is an unforgivable yardstick. Regardless of the excuse, the numbers are the numbers...there's little subjectivity to it.

Since the founding of Resilient Asset Management - 7 years ago in case anyone's counting - I have intentionally allocated a healthy portion of each managed portfolio to international equities. Simply put, this international allocation has not performed nearly as well as its domestic counterpart.

Specifically, the 2 largest foreign commitments used by the firm are the following, with the S&P 500 included for comparison:

- Tweedy Browne International Value (7-Year Cumulative Return): 41.6%

- Baron Emerging Markets (7-Year Cumulative Return): 12.1%

- S&P 500 ETF (7-Year Cumulative Return): 123.8%

And a little closer to home for some, here are the TSP 7-Year Results:

- TSP C Fund (7-Year Cumulative Return): 124.7%

- TSP I Fund (7-Year Cumulative Return): 46.4%

Obviously, in hindsight, the prudent thing to have done would have been to simply load up on the S&P 500 and/or the TSP C Fund and call it a day. Indeed, that has proven a solid strategy over the last decade or so. Unfortunately, a notification doesn't buzz on one's phone in advance of these 7-year moves!!!!

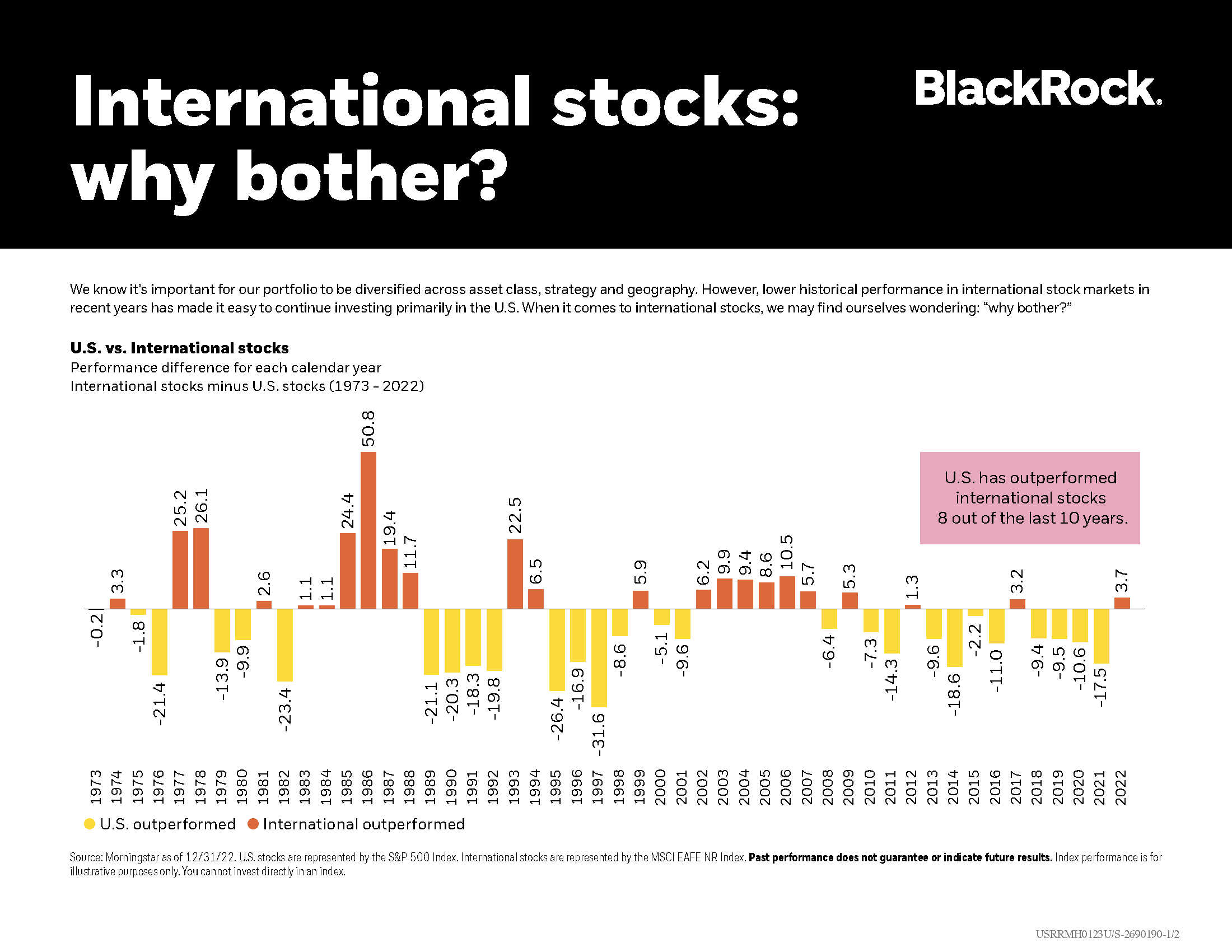

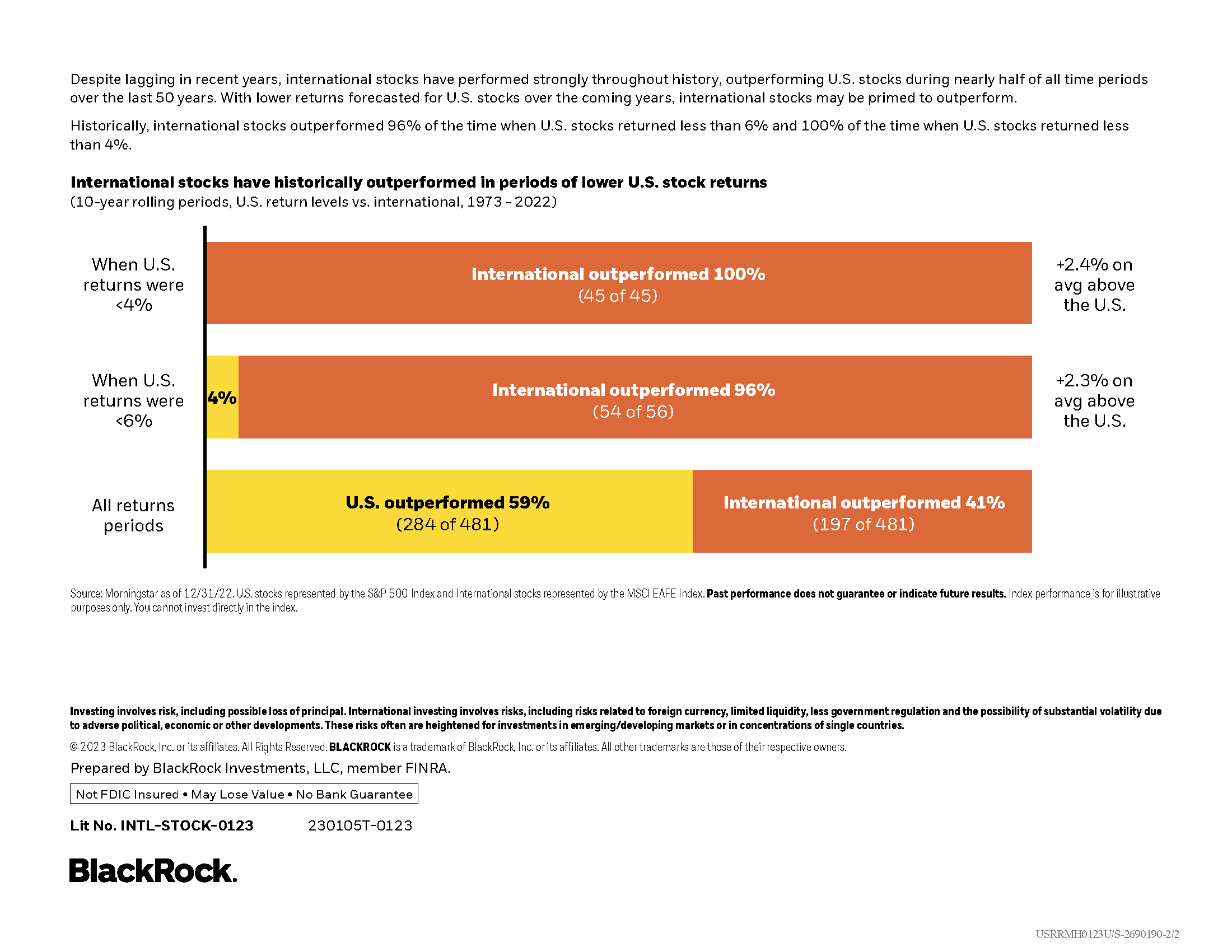

Keeping things in perspective, when you look further back in time, International Stocks have outperformed their US counterparts about 41% of the time. And if you look further into the data, International Equities tend to outperform US markets at a higher rate when US Market returns are in the lower single digits. Please see the below illustrating these points.

Diversification does many things to one's portfolio - spreading risk across asset classes being a primary benefit. Unfortunately, as the manager of the diversified portfolios about which I am writing, it also means I have to "apologize" for some part of the portfolio from time to time.

International investing, or any non-S&P 500 commitment for that matter, has looked foolish recently....with recently being defined as the past decade. Please note, I don't serve you in the hope of not looking foolish. Rather, I try to provide the best advice I can given the circumstances. Each Client for whom we manage assets has an Investment Policy Statement. If you re-read them, I think you will surmise that "piling in" to what I think or feel is next year's best investment is NOT part of my investment philosophy.

So while the S&P 500 has ruled the last 7-years performance-wise, as my grandfather told me, the sun doesn't shine on the same dog's rear end ALL the time. (full disclosure: I have modified his phrasing somewhat). My suggestion for international equities remains the same: stay the course. While past performance guarantees nothing about the future, if you believe valuation matters in investing - which I do - then looking outside our borders may prove beneficial in the coming years.

As we move into the latter part of the year, calendars tend to accelerate somewhat as holiday periods start to stack up. For the Firm, we are hoping to minimize Client meetings in the month of December. We take that time both to recharge somewhat, though we also address a host of internal matters with the Firm.

So if you would like to meet with us, please let us know. For those with whom we think a meeting is particularly warranted, we will reach out to you directly to arrange a meeting.

My next letter to you will come after the New Year. So while it sounds somewhat awkward to wish everyone a Happy Holiday as my Air Conditioner is blaring in the background, please do enjoy the holiday with friends and family.

Thank you all for allowing Resilient Asset Management to assist you in achieving your financial goals.

All the best,

Christopher Flis, CFP®

President

Resilient Asset Management