Selecting the right financial advisor to work with is a big decision. You’ve worked hard to build the wealth that will allow you to retire, and your advisor should be there to help you achieve your vision.

Not all financial advisors are the same, so to help you make your decision, we’re offering an insider’s view of our financial planning tools with the hope that you will have a better understanding of how our process works and how we can help you.

For some people, the financial plan might emphasize only retirement planning. For others, the financial plan might include components like cash flow analysis, education planning, insurance planning, estate planning, and more. Whatever your needs, we can adapt our financial plan to your unique situation.

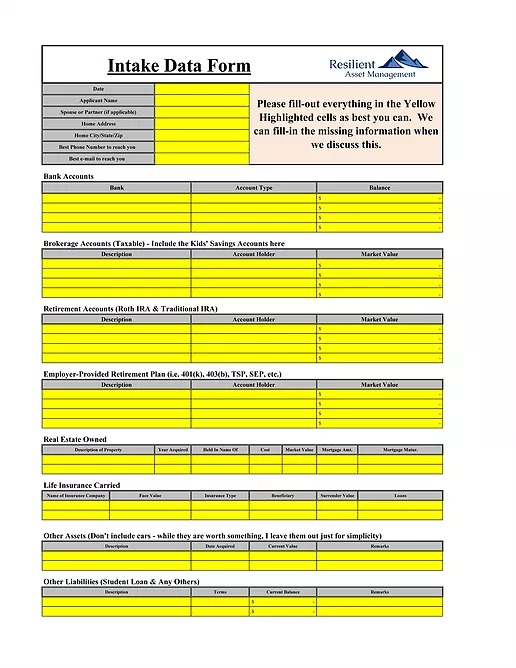

Below are examples of the financial documents we create for our clients to build their financial plan. One of the first documents you’ll fill out when working with us is the Intake Data Form, which provides us the information we need to analyze your current financial situation and develop the necessary strategies to help you reach your goals.

We also request the following from you:

- Tax Returns

- Brokerage Account Statements

- Thrift Savings Plan Information

- Estate Documents

- Insurance Information

- Social Security Statements

- Pay Statements

- 529 Plan Information

- Employer Retirement Plan Information

- Employer Benefit Information

- Other information as required

Please read more about the documentation we request and why we need it on our blog post.

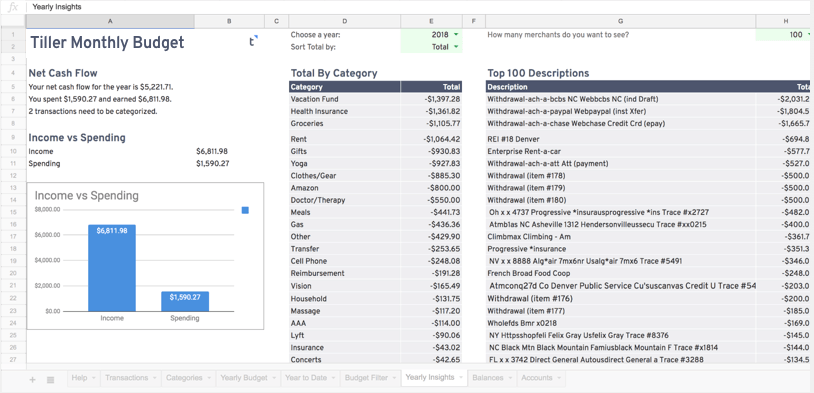

Next, we perform a cash flow analysis to ensure your needs are being met and you’re not sacrificing opportunities to grow your wealth in significant ways. We work with our Clients to identify where their money is going on a monthly, quarterly, and yearly basis. We strive to arrive at two key numbers: 1) a targeted savings amount, and 2) a discretionary spending amount.

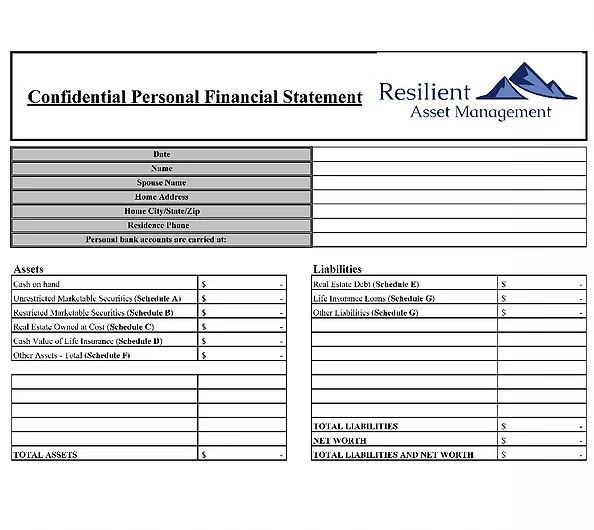

To make informed decisions, your plan needs to include your current assets and liabilities. We track your accounts and investments to have a clear understanding of where you are today. We meticulously track our Clients’ net worth via a Personal Financial Statement. With this tool, we can track ALL your assets (not just investments) and provide access to this overarching perspective of your current financial situation at the click of a button.

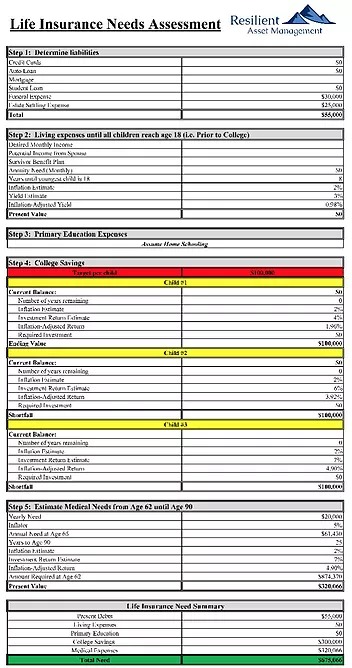

As finance professionals, we know no one can predict the future, so we also incorporate Insurance and Estate Planning into your overall financial plan. At Resilient Asset Management, we have a proprietary method to arrive at a recommendation for our Clients’ Life Insurance Needs.

In addition to Life Insurance, we also assess Disability Coverage, Property & Casualty Coverages, and Employer-Provided Benefits. We don’t sell Life Insurance, though we have an active network of Life Insurance Agents to whom we can refer you for your life insurance needs.

You can read more in depth about our Risk Assessment process on our blog post.

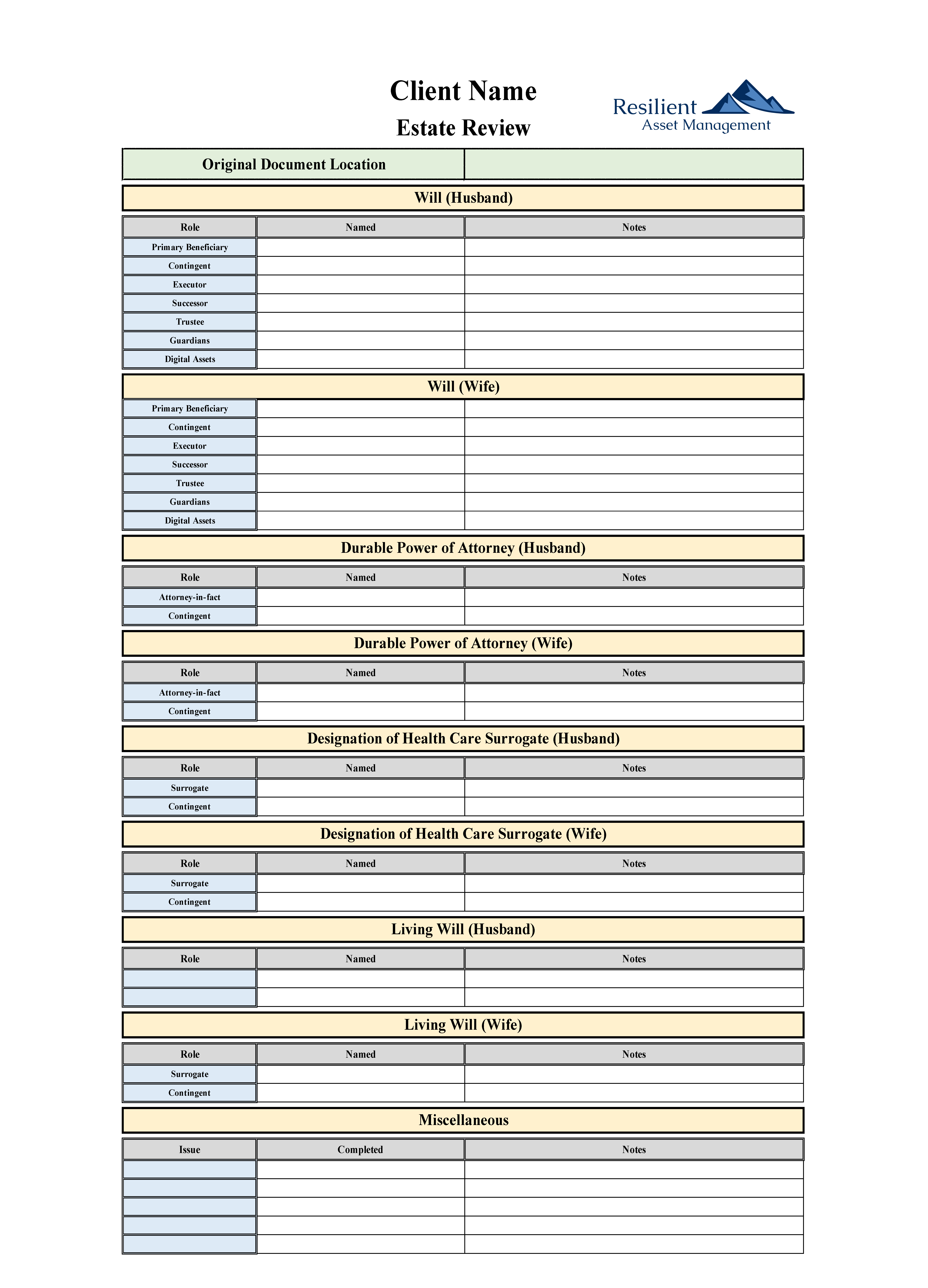

Additionally, we work tirelessly to ensure ALL our Clients have an up-to-date, executable, and cogent Estate Plan. Not only do we ensure our Clients seek out appropriate legal counsel, we also review Estate Plans annually.

Please read more about the documentation we request for your Estate Plan and why we need it on our blog post.

Ultimately, your financial plan is a flexible document, but it’s necessary to have so that when surprises are thrown your way, you’re not lost in the dark. Your financial plan provides the backbone for every decision you make, acts as the guiding hand for what to do when change occurs, and allows us to get you as close to achieving your needs and wants as possible.