Estimating Life Insurance Needs

Insurance, particularly Life Insurance, is not at the top of anyone's favorite things to deal with. Out of necessity, particularly for younger folks with children, Life Insurance typically has to be confronted. The internet is laden with estimators of how much, and perhaps what type of insurance you need. Indeed, these are a very useful tool to add to the decision matrix when evaluating your insurance posture. At Resilient Asset Management, we have developed a simple 5-Step system for our Clients to complement the bevy of tools out there.

Background

Life Insurance dates its beginnings all the way back to Ancient Rome where "burial clubs" paid for an Insured's funeral expenses while also assisting his Survivors. Fast forwarding a bit, Life Insurance as we know it today took root in England. Edmund Halley, perhaps more famously known for discovering the comet that bears his name, wrote the first Life Table, which lists the probability that a living person will live to his/her next birthday.

In the United States, the first settlers from England, who typically were grouped according to religious affiliation, began offering life insurance policies we would recognize today. Sadly, probably due to the underpricing of policies and poor Actuarial estimations, many insurance companies failed, which led to the formation of other insurance companies. There were some happy and enduring stories. For example, the Navy Mutual Aid Association, formed to support those orphaned and widowed after the Battle of the Little Big Horn and to assist the families of United States Sailors who died at sea, was founded in 1879. This remarkable insurance outfit is still thriving today.

The Big Picture

Regardless of what degree of accuracy you seek when estimating your Life Insurance needs, you tend to measure with a micrometer, though you end up cutting with an ax. Meaning, you may calculate your need down to the penny. However, you typically must purchase Life Insurance in somewhat round numbers. Perhaps there is a company offering $1,234,567.89 of coverage; however, this is not a typical life insurance coverage amount.

Additionally, your Life Insurance needs may change over time. For example, children will grow up and perhaps not require financial support. Your savings may increase to the point that your spouse will be adequately provided for should you pass away. You may qualify for a defined benefit pension, such as a military retirement, and look to the Survivor Benefit Program (SBP) to replace some of your insurance products. And finally, your mortgage may be paid off, thus providing a store of value that can also replace some of your Life Insurance needs.

At the end of the day, EVERYONE's situation is different and unique. Therefore, whatever methodology one uses to estimate his/her Life Insurance needs, it (the Method) should be flexible and adaptable enough to allow for your unique circumstances. Let's get into Resilient Asset Management's methodology.

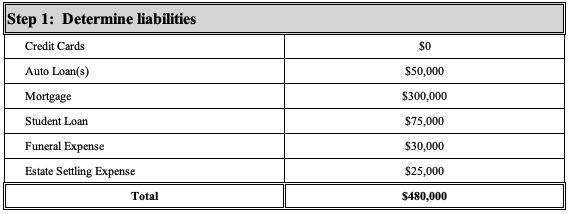

Step 1: Determine the Liabilities

Most, not all, of the bigger liabilities on our personal balance sheets are paid on an installment basis - i.e. we have monthly car and house payments. If the primary earner in a household passes away, we assume the Lone Survivor will want to satisfy these debts, thus decreasing the necessary recurring funds going forward. Additionally, Funeral and Estate Settling expenses are not inexpensive - trust me. Therefore we make an allowance - typically a combined $50,000 or so - for these incurred debts in addition to the typical expenses listed in the following:

- Credit Card Debt

- Auto Loan

- Mortgage Debt

- Student Loans

- Funeral Expenses

- Estate Settling

Here is an example calculation:

The sum of these expenses is the answer to Step 1.

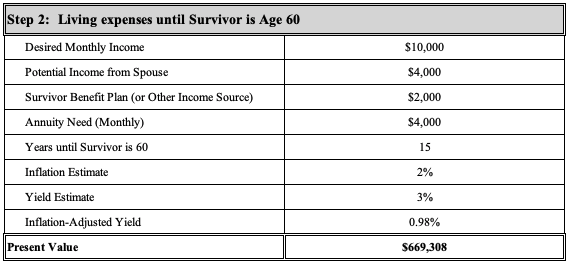

Step 2: Living Expenses Until All Minor Children Reach 18

One of the more important (and larger) items to insure against is the earning power of the Primary Earning spouse. Indeed, for almost any young person, his/her greatest financial asset is his/her ability to earn income. As we get older, other income sources may crop up - marketable security income, rental real estate, or "side hustles". However, for most, having a well-paying job remains the primary asset almost all the way to retirement. Therefore, it is prudent to insure this ability.

Practically speaking, the Survivor is going to want a similar lifestyle as previously, therefore, we have to do some calculations. At Resilient, we ask for a desired monthly income, which is typically near the current income level. Then, we allow for the Surviving Spouse potentially working and for other income sources, such as the Survivor Benefit Plan (SBP). Then, we estimate how long this income level will need to be maintained. Here is an example calculation:

In this example, the Survivor requires an income of $10,000 per month. $4,000 will come from employment, $2,000 will come from SBP, and the balance will be replaced by Life Insurance proceeds. In this case, the 45 year-old Survivor wants this income to Age 60, or 15 years. In order to do this, he/she will need a present day Lump Sum of $669,308. From that amount, we will peel off $4,000 per month, every month, for 15 years adjusting for 2% inflation every year. The fund will be depleted after 15 years.

This Step is highly malleable to account for your specific needs. You may require less money each month - remember, the house, cars, and student loans are satisfied.

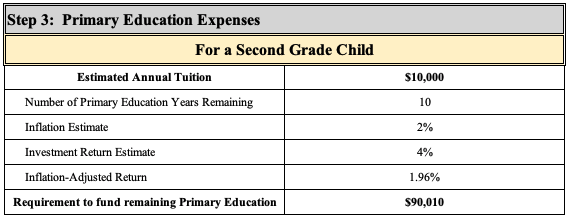

Step 3: Primary Education Expenses

Some parents, for one reason or another, choose Private School for their Children's Primary Education. Much like higher education, Primary Private Schools have escalated in price to the point that accounting for it in a Life Insurance needs calculation is prudent. If Public Schools or Home Schooling are preferred, Parents may omit this step entirely or customize it to their own needs, i.e. account for Activity and Athletic Fees.

For this step, we calculate a required pool of money needed for each child based on the current number of years until the Child reaches Grade 12. Then, we do a present value calculation based on the current tuition requirements. Here is an example, where we assume 2% inflation and a 4% investment return:

So for this example, we would receive an "Education Pool" for this Child's primary education of $90,010. From this pool, we would take $10,000 per year for that year's tuition payment with the remainder remaining invested. Then, in each subsequent year, we would take an inflation-adjusted $10,000 for that year's tuition. In theory, this will provide for the Child's remaining 10 years of Primary education.

Of course, the future is necessarily blurry, so the story may not unfold exactly as depicted. However, the child will have a significant pool of money to pay for upcoming education expenses. And further, you can adjust the investment and inflation estimates to suit your particular need (or estimates of Tuition Inflation)...this was the methodology flexibility to which I referred previously.

You repeat this process for each Child to arrive at the answer to Step 3.

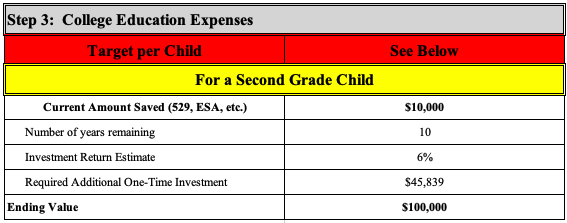

Step 4: College Education Expenses

Anyone with children is well aware of the nose-bleed - and getting bloodier - price tags attached to a College Education. Clearly, if you intend to finance your children's college education, you will want to address this need in your Life Insurance game plan. At Resilient, we ask the parents how much they would like to achieve in a College Funding Pool for each child. Then, we subtract the amounts already saved and earmarked for college. Then, we do a Present Value calculation to arrive at the amount that would have to be added to the College Education Pool so that Junior graduates from High School with the requisite amount of funding his/her parents desire. Here is an example:

In summary, this Child's parents had $10,000 in a 529 (or similar) account. Assuming the Primary Earner passed away, we would add $45,839 to this account. Subsequently, over the ensuing 10 years, assuming a 6% investment return, this sum would grow to the targeted $100,000 for the Child's College Education Pool.

Of course, these numbers are malleable to the Parents' needs. For example, you may wish to account for the coming increases in college tuition, which would increase the target amount per child. Additionally, you may think the 6% return is too optimistic. Decreasing the investment return assumption will drive the One-Time Investment amount higher...you get the idea.

You repeat this process for each Child to arrive at the answer to Step 4.

Step 5: Miscellaneous Expenses in Pre-Social Security Years

Frequently, not always, people tend to target retirement in their mid-50s. For some, sooner is better, either by their own choosing or due to life events. For others, the idea of leaving work is unthinkable. In any case, new expenses tend to creep into our lives somewhere in our mid-50s to early 60s. New prescriptions are started, children are getting married or buying homes and we want to assist, or we simply want to loosen the reins on spending a bit and enjoy more experiences.

At Resilient, we have lumped this general category into "Pre-Social Security Miscellaneous Expenses". I mention Social Security here because typically (NOT ALWAYS) we tend to steer Clients to claim Social Security benefits at Age 70, resulting in the highest monthly benefit allowed for each individual. Of course, this recommendation varies based on a variety of factors.

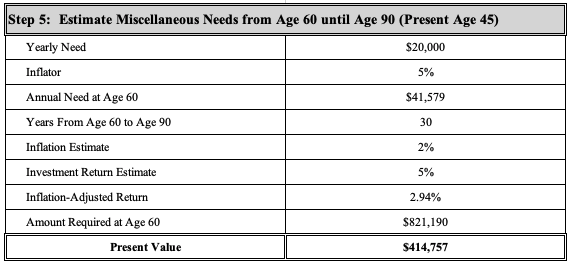

The amount and duration of these "Miscellaneous Expenses" can vary widely. All things being equal (and they never are), we use Age 60–90 for duration, $20,000 per year in today's dollar as the amount needed, and lastly, we assume 5% inflation for the expenses we are considering. You may disagree on the 5% number, which is fine. However, if you have an eye on medical-related expenses — we do — 5% might even be a bit low for an inflation estimate. Here is an example:

The above graph is telling you the following for a Present Day 45 year-old potential Lone Survivor:

- $20,000 in "today's dollars" inflated at 5% is $41,579 15 years from now.

- At Age 60, in order to receive an inflation-adjusted $41,579 each year, you need $821,190

- Assuming a 5% Investment Return over 15 years, you need $414,757 today to get to the target amount of $821,190 in 15 years

Thus, if the Primary Earner passed away, we would invest $414,757 in a Lump Sum from the Life Insurance proceeds. This amount would grow to $821,190 over the ensuing 15 years. Then, at Age 60, we would withdraw $41,579 each year an inflate that amount by 5% each subsequent year to Age 90.

Obviously, this Step will add a good bit to the Life Insurance amount. There are a myriad of adjustments one can make to the calculation: change the duration, inflation rate, or yearly need and the Present Value needed is going to change, perhaps dramatically.

Whatever you decide, it is important to think through the potentialities surrounding your circumstances and account for them in your calculation. In many cases, people show up to their senior years under-saved. This methodology is a way of providing some insurance against unforeseen circumstances you might not have anticipated.

Putting It All Together

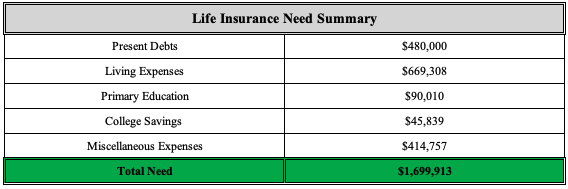

To arrive at the initial estimate of Life Insurance to be retained, we simply sum up the calculations of each of the 5 steps. For the example above, it would be the following:

Assuming we employ the methodology described above, we would seek Life Insurance tallying $1,699,913. Then, if the Insured were to pass away, the Survivor would do the following:

- Pay-off the House

- Pay-off the Cars

- Pay-off the Student Loan debt

- Pay for the Funeral

- Pay for the Estate Settling expenses

- Establish a Primary Education Fund for each child

- Establish a College Education fund for each child

- Invest $414,757 into a fund not to be touched until Age 60

- Establish an investment fund to provide $4,000 in inflation-adjusted income

Clearly, this is a well-provided-for Survivor. That said, this is only a plan from which to deviate. As I mentioned previously, this methodology is ultimately customizable to your needs. The idea is to arrive at an insurance amount that makes sense and is both affordable and attainable.

Other Considerations

Life Insurance needs can change over time. Typically, not always, Life Insurance needs decrease as people age. To account for this, you can do a variety of things. Among them, you can purchase multiple Life Insurance policies, each with a different term and amount. With this strategy, you are looking to stagger the termination of your Life Insurance policies. Additionally, you may have permanent Life Insurance needs - say for a Buy/Sell Agreement in a privately-held business - rather than temporary ones. Rest assured, if you have an insurable need, you can find an insurance product out there to meet it.

Conclusion

This is one, just one, method to use in estimating your Life Insurance needs. My suggestion is that you use this methodology and compare it to some of the other tools available and compare the results. Then, hypothesize what the Survivor would do with the lump sum of funds received. Make adjustments to your estimates and arrive at your best estimate of what you need for Life Insurance and how many policies and duration you need. Then, you will have a plan to provide for your loved ones should you pass away prematurely.

Comments, criticism, and suggestions are always welcome. If you would like to provide any or would like to discuss your personal situation with Resilient Asset Management, please contact us here.