2024 Q1 Client Letter

To the Clients of Resilient Asset Management:

Greetings from World HQ in Memphis, TN - I trust all of you enjoyed the Easter Holiday with your loved ones. We sure did...the energy of the Easter Egg Hunt remains at a fever pitch in my house - that's for sure.

Speaking of a fever pitch, 2024's stock market sure had a great quarter where continued gains built on 2023's final surge. Where things go from here is anyone's guess - of course, arguments for positive and negative future performance abound. If the past 12 months have demonstrated anything, staying invested remains, as it always has, the wisest strategy.

This quarter, a few disconnected thoughts to share:

Cybersecurity

As we move ever closer to "full digitization", cybercriminals continue to prey on the unprepared. Despite all the technological advances around us, the primary defenses of password integrity and avoiding spurious email links remain the bedrock of all defense postures. If you don't believe me, catch this part of this NBC News video:

The GOV official being interviewed, somewhat ironically, was the Brigade Commander my first semester Plebe Year (what I understand was the hardest of any Plebe Year) at the Naval Academy. Incidentally, the interview occurred on "the yard" (Academy Lingo) in Memorial Hall.I CANNOT repeat these basic (and simple) Cyber Defenses enough:

1) Use a Password Manager so you have unique and challenging passwords;2) Use Multi-Factor Authentication (MFA) whenever it is offered;3) Never give personal information on a phone call you did not initiate

If you follow those 3 guidelines, you won't be fully inoculated, though you will be much better off than most. And more importantly, you will deter most Cybercriminals.

Interest on Your Cash

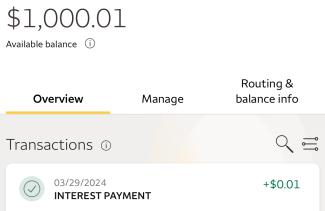

I have fielded more than a few calls from Clients regarding funds they have on deposit at their bank. As practically everyone is aware, interest rates have been on the rise....apparently, some banks did not get the message. Back in the day, where you held cash didn't matter as very little interest could be garnered. Now, that situation is decidedly the opposite.At my bank - I'm intentionally withholding the name - the situation was no different....see image below to see the earned interest this past month on the $1,000 in one of my savings accounts - hello one cent!In December, I decided I'd had enough and I consolidated most of my cash into a regular taxable brokerage account. The one I use pays about 4.7% or so. When you compare that to my one cent, per $1,000, I am now earning $47 ( $1,000 * 4.70%) per year as opposed to 12 cents ( $0.01 * 12 ). And this is all entirely risk-free...Never in my life did I imagine I'd earn 4.7% risk-free just by pressing a few buttons.So I wanted to pass along this information to you. Right now, RAMCO's primary custodian, SSG, is paying 4.75% +/- on cash with no gimmicks, lockups, chicanery, or penalties - just straight interest.Therefore, if any Clients reading this are looking to earn a bit more yield, simply let us know and we will arrange to have your funds moved. The only real "issue" is accessibility...if you let us know you need the money before noon Eastern Time, you will likely have the funds the same day. Otherwise, it will be the next morning.For those combing the internet for "teaser" rates approaching or perhaps modestly more than 5%, please read the fine print:

- Can you access the funds?

- Do you incur a penalty if you do access the funds?

- Are the proceeds rolled to a new, lower-paying product upon expiration?

And don't forget, as you might be lamenting now: you have to dig-up a 1099 for any investment income you earned. So I'd consider keeping it simple here and not stretching too much for yield (or more admin hassles).

Investment Performance

In a couple of Client meetings, the topic of investment performance has also come up. Since Investment Management is one of RAMCO's 5 cornerstones, it is certainly understandable why one would be concerned about this important metric.Before going further, you should know that the VAST majority of Clients have the same basic asset allocation amongst 3 broad categories: Domestic Equities, International Equities, and Fixed-Income. Depending on a variety of factors, the weighting differs, though the composition of the constituent parts is essentially identical.For the Domestic Equity portion, the backbone of the portfolio has been and will continue to be the S&P 500 Index, invested by means of either a Mutual Fund or Exchange Traded Fund. For the International Equity sleeve, until recently the backbone international investment at RAMCO was the Tweedy Browne International Value Fund.Please consider the following numbers:

Period #1: March 2014 - March 2024 Total Return:

S&P 500: 229.93%Tweedy Browne International Value: 58.03%

Period #2: March 2004 - March 2014 Total Return:

S&P 500: 97.13%Tweedy Browne International Value: 116.43%

I will caution you in advance - whenever ANYONE (including me) is talking about performance numbers, the writer is at a distinct advantage because he/she can choose amongst a variety of variables to illustrate his/her point.The point I am attempting to illustrate deals with International Equities.As any observer of Investment Performance is aware, the US S&P 500 Index has been a performance monster over the past decade. For reinforcement, just look at the Period #1 performance numbers. In hindsight, the obvious thing to have done 10 years ago would have been to invest everything in the S&P 500 and forget the other parts.Of course, we don't know this information in advance. For proof, look at the Period #2 numbers. The International Commitment would have been a better decade-long commitment compared to the S&P 500 from 2004 - 2014.The key here is NOT to look at recent performance as an indicator of future performance. As if often disclaimed, past performance guarantees nothing about the future. Moreover, had I published this letter in March 2014, the popular narrative may have been that US Equities were "dead" and we should pile into the foreign stocks.Over the long-term, International and Domestic Equities have much more similar performance than we've seen over the past decade, just look at Period #2 again. When I write that, I am making no prediction(s) about where we are going. Rather, I am simply stating that it is possible for International Stocks to outperform Domestic ones. Moreover, as an Investor, one has to evaluate the price of investments relative to their value and make informed judgments on where to commit funds.Right now, by most historical standards, particularly current prices relative to the earning power of the shares, Domestic Equities appear a bit stretched. Their foreign counterparts, conversely, appear less stretched, relatively speaking. I write that knowing that valuations can become truly distorted - those of us who can recall the DOT-COM bubble know this all too well.At the end of the day, I can't predict who will triumph in the performance comparison between US and Foreign equities, which is why I recommend broad diversification amongst each. In support of this concept, Resilient Asset Management maintains a capital account equally weighted between international and domestic equities invested in the same commitments we recommend to you...indeed, the Firm eats its own cooking in this regard.In short, unless you have a specific reason for not investing in Foreign Equities, I recommend you keep your investment allocations as we have recommended. History has shown that "performance chasing" is a poor strategy to enhance one's investment returns.

Closing

With Spring upon us, I wanted to again thank all of you for being Clients of Resilient Asset Management. For our longest tenured Clients, we wholeheartedly appreciate you jumping onboard in the Firm's infancy. For those who recently joined the fold, we thank you as well for pushing the Firm to new heights. We have intense optimism about the future.

As always, we stand ready to assist with all your financial needs. If any of you require personal attention to your financial matters, please contact us appropriately.

All the best,

Christopher Flis, CFP®

President

Resilient Asset Management