Banking Crisis: 2023 Q1 Client Letter

Greetings from World HQ in Memphis.

Lots going on in the financial world....enough to necessitate the "pop-up" note I sent you previously about the recent banking crisis. I have a few more words about banks in the video above to accompany this letter. Also, a few points for you:

First, keeping our eye on the ball - try to be most mindful of those issues upon which you can have a direct impact. Currently, please make sure to review your Income Tax Return prior to filing. Tax Season is the playoffs for CPAs and a lot of numbers are keyed-in. No one is perfect, so please give your return at least a thorough once over, particularly if you are receiving a large unexpected refund or tax bill. If you like, the offer is open for us to review your return as well. Beyond taxes, try and keep a long-term focus...this mindset will assist in filtering out the ever-louder noise from the various media sources.

Second, timeless principles. Regardless of the inflationary picture, the state of the economy, or whatever else, the "timeless" principles of an Emergency Fund, Spending less than you make, and not overreacting to markets remain firmly in-place. These tenets will ALWAYS be in the financial bedrock. The steady diet of breaking news with seemingly fracturing impacts on your life and finances will NEVER abate. News sources are in the business of selling news, not providing you with advice. While I am not suggesting to dismiss everything you hear or read, do consider it in a broader context. Today's headlines will gently pass from the front page, to the backpage, and then to the circular file.

Third, market timing. I have heard from a Client or two and also heard it suggested by market pundits that it's currently advisable to "not be in the market". Let's unpack that for a minute and spend the most time on this topic.

Assuming from today's prices that markets are in-fact destined to go lower, presumably one would be inclined to sell all securities in the portfolios and wait for the "all clear" that "getting back in" is advisable.

Let's consider things....if one were to assume market direction was widely-known by most participants, then wouldn't this market direction thesis be reflected in current prices? It seems safe to assume that most market watchers are, at a minimum, somewhat aware of, among other factors, the current threat of recession and continued inflationary concerns.

Leaving aside how widespread market direction information might be, let's further assume one decides to pull the plug on equities and move to the sidelines in cash....what then is the signal to buy back what was sold? This singular question is usually NOT answered by those suggesting the outright sale of stocks is currently warranted. The pundits rarely even discuss the criteria for reinvestment.

Unfortunately, no one is ever going to tap you on the shoulder and say "Now's the time"...the equity markets unfortunately just don't work that way. It would be nice if our phones buzzed at both the top and the bottom of equity markets - I think we all know that's an impossibility.

So that leads to my two points related to the topic of market timing. First, if one attempts to adeptly weave in and out of the market, success is ultimately determined by being right twice - on both the buy and the sell trades. This is no easy feat as my second point will attest.

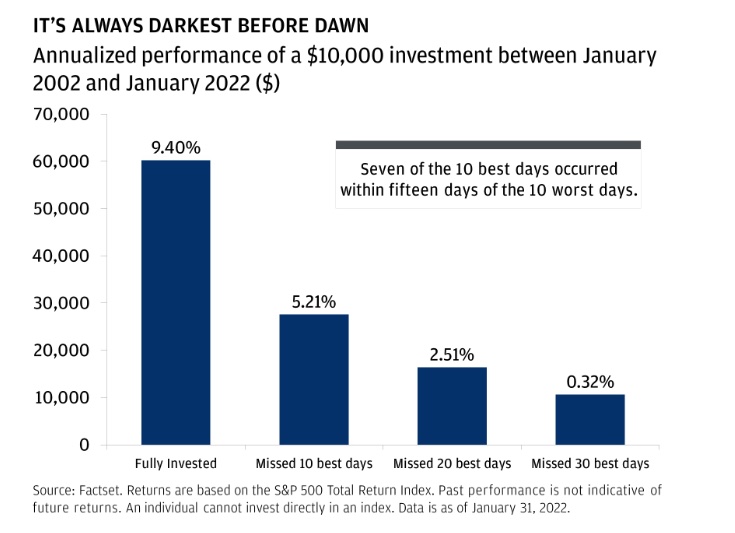

JP Morgan distributes A LOT of investment-related data. For most people, definitely including me, one of the most relevant charts is attached. The following chart deals with missing certain trading days in the market:

In case the graphic did not display correctly, I have also attached a PDF of it. And here is a table replicating facts depicted in the chart. From 2002 until 2022, here are investment results of the S&P 500:

Fully Invested for 20 Years: 9.4% Annual Return

Missed 10 Best Trading Days: 5.21% Annual Return

Missed 20 Best Trading Days: 2.51% Annual Return

Missed 30 Best Trading Days: 0.32% Annual Return

Over 20 Years, there are approximately 5,200 Market Trading Days. According to this chart, the bulk of investment returns are earned on only 30 of those days. Let me repeat that differently, 96.5% of your investment returns were earned on only 30 trading days from 2002 to 2022. And even more vexing, 7 of the 10 best trading days occurred within 15 days of the worst trading days. For completeness, I seriously doubt ANY 20-year period has significantly different data.

So, anyone looking to "pick their spot" in the stock market better be very, very good because there are only about 30 days where one can do their best work. Even if we were to assume future market returns could be realized on 100 trading days instead of 30, the odds are still VERY decidedly against success when market timing is fully relied upon. My take, to paraphrase Green Day: Market Timers' fate rests on broken glass.

Counter to market timing, one could choose to be a fully-invested long-term market participant. At a minimum, this investor has eliminated the buy/sell decision described previously. And, the fully-invested investor guarantees to be "in the game" on all the best days of market trading. To be sure, there will be gut-wrenching days, though that's the way it is...I have no tonic for it other than to suggest looking at something other than your investment account those days.

For various reasons - short-term funding needs, retirement spending, or college tuition - most Clients of Resilient Asset Management are not "fully invested". However, no Client can say I've suggested market timing of any sort. Rather, money is placed on the sidelines for either pre-identified strategic purposes or at Client direction.

Hopefully, the last part of this note has put any talk of market timing to bed. Media glorifies those rare individuals who are able to predict market activity - either up or down. However, for as rare as it is to be able to accurately predict market movement, it's even rarer for those individuals to have a second act predicting markets.

The easiest successful strategy to replicate is to be a long-term investor committed to a specific investment strategy...the odds are greatly stacked in your favor using this approach.

Thank you all for your continued trust in Resilient Asset Management. We are honored to assist you in achieving your financial goals. We want to wish all of you a Happy Easter Season and hope you enjoy the holiday with your family and friends.

As always, if you would like to schedule time to discuss your personal financial situation, please do not hesitate to contact us.