Resilient Asset Management 2024 Q2 Client Letter

To the Clients of Resilient Asset Management:

Greetings from World HQ in Memphis. I trust you all are anticipating Independence Day with loved ones and the well-deserved respite from life's busy-ness. If you have some time, I suggest a re-read of the Declaration of Independence itself. I still marvel at the collective courage it took to declare independence from what at the time was the most powerful nation on earth. It seems undoubtable that the Declaration's signatories could not have possibly entertained ANY idea of what their new nation would become. Indeed, the United States remains the envy of the world - believe it.

Moving along to financial related matters, a few varied thoughts:

Cyber Security

I am leading off with this one again as this is the most actionable tidbit in this note, which I realize is a repeat from last quarter's letter.

Some of you may know about the CDK Global Cyber Attack. For those who are unaware, CDK Global is a company whose primary business is to provide software to car dealerships. This company was "hacked" recently, thus crippling almost all car dealerships (and their service departments) throughout the country. As I understand it, some dealerships went back to the "stone age" and were processing work orders with pen and paper. Also, and somewhat inexplicably, it is rumored that CDK may have paid, and also asked dealerships to pay, the ransom to free their data.

Don't let anyone fool you - cyber threats pervade the landscape and the criminal mind is exceptionally resourceful in this area. And we've made it demonstrably easier for these nefarious individuals by centering our digital lives around our mobile devices.

So what do we do? Here is a quick checklist:

- Use a Password Manager and establish unique passwords for each of your accounts

- Arrange Multi-Factor Authentication whenever possible

- Don't have financial conversations with anyone where you did not initiate the phone call

- Be very careful who you let handle and/or manipulate your phone

This list isn't completely disaster-proof. However, if you do all these things, and are fastidious about keeping your cyber security guard up, you will make most criminals move on to the next thing.

A quick story to illustrate about point #4 above - true story. My son enjoys going to the Memphis Zoo. This year, the Memphis Zoo introduced many experience enhancements, including the on-line purchasing of tickets, seemingly a good thing. Well, when I attempted to enter the park, the Memphis Zoo Associate, who was inside a locked booth, asked me to put my phone into a drawer so he could scan the barcodes on my tickets.....no freaking way!!! A seasoned criminal can wreak havoc on your life in mere seconds with access to your unlocked phone. If you don't believe me, you can read about it here.

The Magnificent Seven

Anyone who follows capital markets is well-aware of how powerful the recent market performance of the leading technology stocks has been, particularly Nvidia. Indeed, a properly-sized investment in Nvidia just a few years ago could have made (and probably did make) an entire investing career.

Fortunately, Nvidia, along with the other 6 "also rans" in the Mag 7, are heavyweights in S&P 500 Index Funds. The performance of these 7 companies has been so great that excluding them from the Index performance leaves much more pedestrian performance.

As a rough example, I can share 2 different index performance metrics -

(i) The Cap-Weighted S&P 500 Return; and(ii) The Equal-Weighted S&P 500 Return

Please note, a "Cap-Weighted" Index Fund invests more in larger companies than in smaller ones. Conversely, an equal-weighted fund invests the same in each component.

Market Cap Weighted S&P 500 YTD 2024 Return: 16.96%Equal Weight S&P 500 YTD 2024 Return: 4.61%

Fortunately, the Index Fund investment I use is Market Cap weighted, so all of you have enjoyed the outstanding year-to-date performance in your Index Fund investments.

I want to caution you against expecting this type of return going forward. A 17% return in 6 months is 34% annualized. Given the S&P 500's 50-Year annualized (Per Year) return of about 11.5%, 2024 is a true outlier. As you know, I don't make market predictions; however, I do like to manage expectations, so anyone projecting 17% returns every 6 months in perpetuity should consider themself forewarned.

Regarding Nvidia - there is no doubt about its impact on our society and the greatness of its CEO Jensen Huang. Present performance notwithstanding, I would humbly suggest that Nvidia has a head start in the AI race. Nvidia has many, many legitimate competitors. One need only look at another recent computer chip champion - Intel - as an example of what can happen to the top dog in this space. Intel....it is hard to fathom how far that former titan has fallen from grace.

As another example, I am sure most of you have heard of Cisco Systems. This great company was the Nvidia of its day - that day being the early 2000s. Back then, Computer Networks were the rage that AI is today. In fact, Cisco was once the most valuable company in the world - $500 Billion at the time. Well, competition coupled with passing euphoria leaves Cisco's current market capitalization at $189 Billion 24 years later.

I'm not predicting that type of performance for Nvidia. What I am saying is that falls from grace can be particularly stark, especially once the fever breaks.

International Stocks

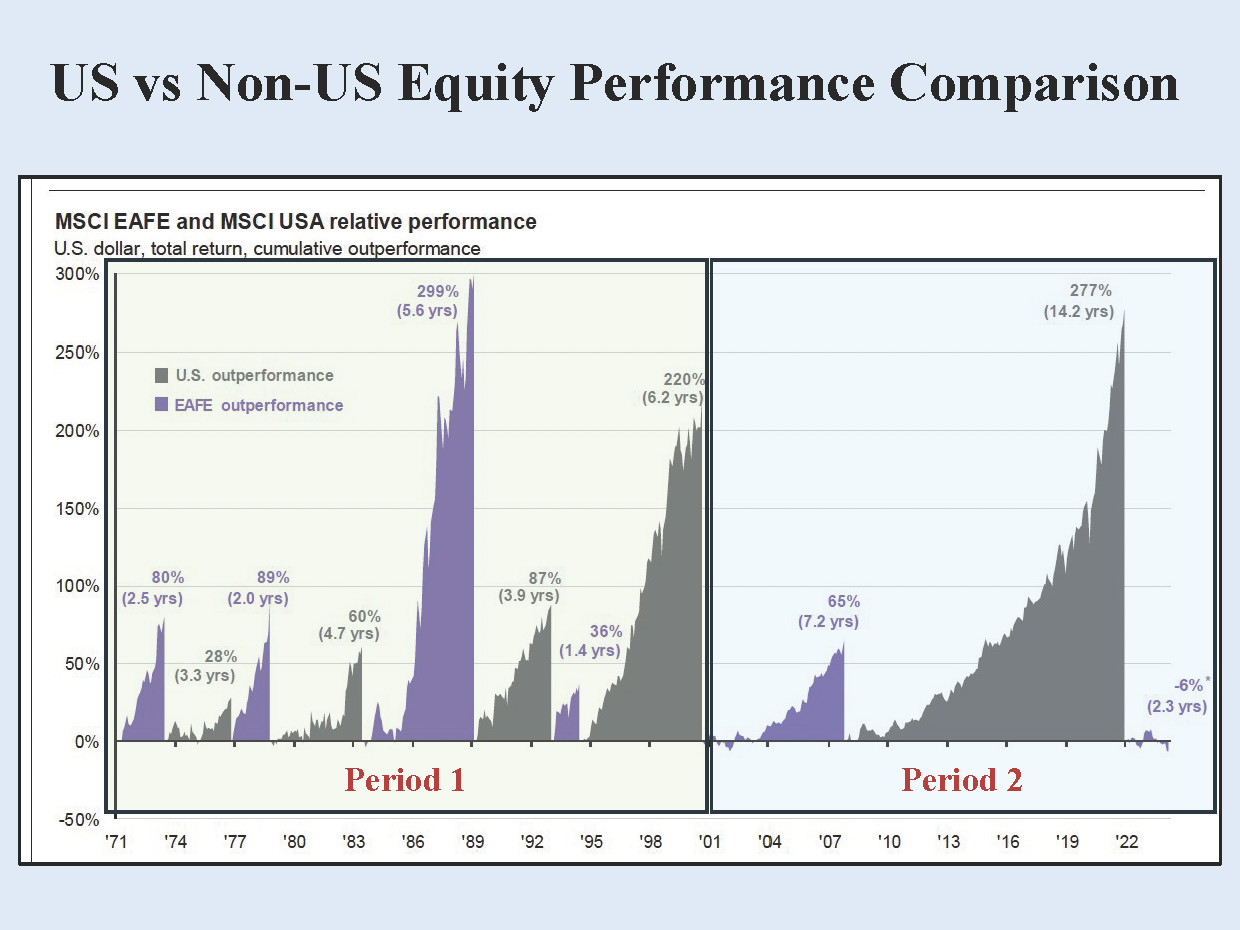

I have had more than a few discussions about International Stocks recently. Having written a bit about this last time, I won't belabor any of the previously made points. Rather, I have included what I think is a revealing chart for your reference - it is attached as Figure 1.

In this chart the performance of US vs. Non-US stocks is plotted. The outperformer is plotted as a positive number, ie if US Stocks outperformed their foreign counterparts by 5%, 5% is plotted and colored gray. Foreign stock outperformance is plotted in purple. I have subdivided the chart into two chronological periods: Period 1 = 1971-2000; Period 2 = 2000-2024.

In period 1, Non-US stocks had a net performance advantage of 109%. In Period 2, US Stocks have enjoyed about a 206% performance advantage. To anyone suggesting otherwise, International Stocks can indeed outperform.

In behavioral finance, there are 2 major concepts about which you should be aware. First is recency bias. Simply put, individuals have a tendency to project what has recently happened into the future. With investing, this is known as "performance chasing" - when investors pile-in to what investment has gone up the most in the past year. History has shown this strategy to be exceptionally bad - reference the Cisco example above.

The other concept I wanted to explain was home country bias. Investors tend to have a strong tendency to invest in the stocks of their home country. For US Investors, this has recently worked tremendously in their favor. For Non-US Citizens, not so much. Regardless, Investors tend to want to invest "at home".

I explain all this to make a few points:

- With investing, overcoming biases is very, very important

- Foreign Stocks have had periods of significant outperformance - 1985-1989 being the prime example.

- Outperformance tends to bunch over a number of years

- The US has had a massive, and somewhat unprecedented recent run - 14 years

None of this guarantees anything about the future. However, when assessing the current market dynamics and relative valuations, International Equities certainly deserve some attention, thus their inclusion in your portfolios. An integral part of investing is patience. For the past decade, International Investing has afforded ample opportunities for all of us to work on our patience skills.

Upcoming Election

As all of you are aware, there is a Presidential Election coming up. Since another quarter will close prior to the general election in November, I will have the opportunity to more thoroughly address election-related matters then. For now, please understand that we monitor the markets every single day they're open. Moreover, we also stay abreast of market-moving news.

As a precursor of next quarter's letter, I recommend you put your personal political views aside when it comes to your investments - mixing the two can seriously muddy the water (and the mind). Presidents will come and go - the US will persevere onward and upward...more to follow on this topic. If you simply can't wait, you can read a previous election-related BLOG post I wrote here.

Conclusion

We wish all of you a happy and safe 4th of July Holiday. Please enjoy some respite with your loved ones as you celebrate our great Nation's independence.

Please contact me directly if you'd like to arrange a time for us to speak about your personal financial situation.