Social Security – Don’t Believe the Hype

Social Security is frequently referred to as the “Third Rail” of American Politics. Much is written about this storied program in the media with predictions ranging from the program’s demise all the way to its expansion. Given the wide disparity, I thought I’d share a bit of my take on the program.

Background

Before going further, a bit of history. As some of you might be aware, the Super Bowl was recently played between the Chiefs and the 49ers. The NFL’s playoff games were of course contested prior to the Super Bowl. As my wife will attest, I am a bit “unreachable” on the three weekends comprising the NFL Playoffs. In an interesting wrinkle, this year one had to subscribe to the streaming service Peacock to watch 2 of the games. Without further discussion, I will confess to being a Peacock subscriber.

In addition to purchasing viewing privileges to the 2 NFL games, one could also access the vast Peacock video library. One evening, I was poking around the Peacock library and happened upon, of all things, the Tonight Show starring Johnny Carson library.

The Tonight Show and Social Security Commentary

Dating myself somewhat, I was pretty young when Mr. Carson’s show was at its height. That said, even in my youth I realized, like many others, that few could do a “bit” as well as Mr. Carson. One of my favorites was “Carnac”. Mr. Carson would don a Sultan costume with full head garb while his sidekick Ed McMahon would introduce him as, “A famous visitor from the East – famous seer, sage, soothsayer, and former Air Traffic Controller – Carnac the Magnificent”. This particular bit entailed having “Carnac” say the answer to a question that was “hermetically sealed” in the envelopes Mr. McMahon was holding.

While scrolling through Peacock one night, I looked for an episode with a “Carnac” bit. The episode I found aired on March 3, 1982 (Season 20, Episode 105). At the time, the Social Security Program was under review as it had run into many issues not so dissimilar from today’s. Many knew the program was in peril and some feared its collapse.

Tying this all together, the last of the “questions” on this episode was as follows:

Carnac’s answer: “Dr. Pepper, Barney Miller, and the Social Security System”.

Ripping Mr. McMahon’s envelope to reveal the question, Carnac recited: “Name a Pop, a Cop, and a Flop”.

A Dose of Reality

To repeat, that episode aired over 42 years ago. Shortly after that show aired, some major revisions were made to the Social Security Program. Interestingly, if one had claimed the average Social Security benefit on the show’s production date, and subsequently lived to today, he/she would be 107 – the program’s Full Retirement Age in 1982 was 65. This same individual who claimed the “average” amount would have received total payments of – wait for it - $501,576 as of the month of this writing, March 2024. Not bad for Carnac’s “flop”.

Two ends of the Social Security Spectrum

The primary reason I’m publishing this article is the numerous misconceptions about Social Security. For starters, let’s bracket. On one end, let’s address the program’s existence. For those who are unaware, Social Security is currently MOSTLY funded by payroll taxes we all pay. For employees, you pay 6.2% of your paycheck up to the annual limit – this year (2024) the annual limit is $168,600. Your employer pays a symmetric 6.2%. For self-employed individuals – ugh – you must pay the full 12.4% yourself, though you do get to deduct 50% of the payment just as an Employer would.

So as long as we have people working in the United States, at least the annual payroll taxes will be available to pay current beneficiaries. Anyone announcing something like “Social Security is going away”, or “Social Security is not going to be there” is seriously, undeniably misinformed. That’s one end of the spectrum.

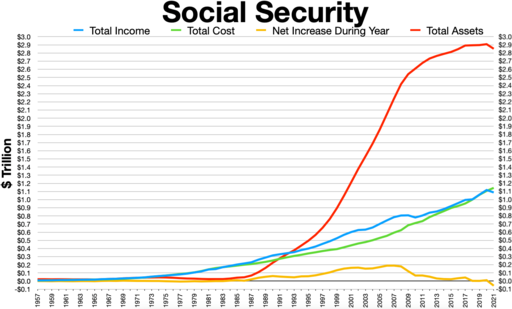

On the other end of the spectrum, anyone saying Social Security will persist in perpetuity in its current form would be similarly misinformed. Going back to 1982, the Social Security actuaries realized the program needed adjustments…the “Third Rail” was at risk of going cold, so the politicians had to act. Saving you the history lesson, the resultant changes caused the Social Security Trust Fund, the reserve where excess Payroll Taxes not paid to existing beneficiaries went, to grow EVERY year from 1982 to 2020. If you don’t believe me, here are the actual numbers: SOCIAL SECURITY TRUST FUND, 1957-2023.

In 2020, the same realizations about the current iteration of the Social Security System came to light – specifically, the “program” was paying more in benefits than it was collecting in revenue. Thus, anyone who says the current scheme is sustainable with no changes required simply does not understand the mechanics of the Social Security system in its current form.

Potential Changes to the Social Security System

Another glaring indicator of the misinformed is that a “Silver Bullet” exists for Social Security to patch everything up. For example, one common suggested “fix” is to eliminate the cap on the amount of earnings subject to the payroll taxes that fund Social Security. In 2024, this amount is $168,600 – no Social Security payroll taxes are owed above this amount of earned income. The “fix” would be to eliminate this cap and, voila, we can all take the rest of the day off. Not so fast…the Social Security Administration actually already studied this fix and found that this solution would extend the exhaustion of the Social Security Trust fund from 2033 to 2057. An improvement to be sure, though hardly a long-term solution.

For anyone thinking they have the answer to Social Security’s issues, I would caution against thinking your solution is novel. Social Security maintains (and publishes) an extensive library of every legislative proposal to address Social Security’s issues – the list is exceedingly long. You can reference the site here: SOCIAL SECURITY SOLVENCY INDEX

In truth, Social Security is a complex beast of a program with rules upon rules that any one person could spend a lifetime attempting to master. In something of a modern day Carnac bit, I was on the phone with a Client when she phoned Social Security to make an adjustment to her claim. I actually had to have the Social Security Agent Google the provision we were attempting to leverage on my Client’s behalf. It all worked out; however, the lesson is clear: even the Social Security Agents – bless them – are not aware of all the rules.

Key Takeaways

For now we can suffice it to say that Social Security is going to be there in some form going forward. Indeed, politically difficult decisions will have to be made at some point. While seemingly an urgent issue, the prospect of the Social Security Trust Fund going to $0 in 2033 is a political light year from now, thus the paucity of action on this all-important item.

Sooner or later, reality will set in and true negotiation on which combination of fixes to enact will take place. Surely there will be winners and losers in that struggle. However, keep in mind that at no point has the Social Security Administration suggested benefits will not be available. The lowest percentage of today’s benefits that I have seen is 72 percent a long, long time from today. Being an optimist, if the worst-case scenario I have to endure is that I will have 28% downside in an Armageddon-type scenario, I am not going to lose too much sleep over that. I freely admit that others may differ from that view.