Demystifying Your Amazon RSUs

It’s not uncommon for individuals to retire from the military and head over to Amazon for their first post-service civilian job. This can be a significant change in both the work environment AND compensation. As a financial advisor, navigating the work environment is outside my sphere of expertise. Compensation, however, is right in my wheelhouse.

One of the most significant compensation differences for any new Amazon employee is equity compensation. For Amazon, this comes in the form of Restricted Stock Units (RSUs). While multi-faceted, these semi-complex structures can be broken down into simpler parts to provide a thorough understanding of how they can align with your overall financial plan. We will try to “demystify” RSUs here today so you can make the most informed decisions for your finances.

What You Need To Know About Amazon Compensation

The main parts of Amazon’s compensation structure centers around two key elements: cash and RSUs. To be crystal clear, there are other aspects of Amazon’s benefits package; however, the focus today is on RSUs. The cash part is the easier part to grasp as it is the most familiar to us: show up for work, do the job, and once or twice per month, you receive compensation in the form of a paycheck. You can then use this currency however you’d like to live your life, pay bills, or save for a rainy day.

Amazon, in its wisdom, seeks to, among other things, align the interests of the company with its employees. To do this, part of every employee’s compensation is partially in RSUs. This form of compensation incentivizes employees to think like owners and do what is best for the company in the short and long term. Collectively, this benefits both the employees and the company—this is capitalism in action. This is not an uncommon theme in corporate America.

Key Terms

In the most basic sense, Amazon RSUs are a form of deferred compensation. Let’s look at how Amazon RSUs are mechanized. On your hiring date, you are granted an initial batch of RSUs. There are three important pieces of data to be aware of:

- The grant date

- The vesting date

- The grant price

Let’s drill down a bit deeper into these three elements.

Grant Date: This is simply the date your RSUs were granted to you. Don’t overcomplicate it!

Grant Price: From the grant date until the day before the vesting date, the value of the RSUs will fluctuate with the price of Amazon’s publicly traded stock, Ticker: AMZN. By fluctuating, that means the price of the shares can go both up AND down. Whatever the movement, during this intermediate period, you have no rights to buy, sell, or otherwise trade your RSUs. Also, you are not responsible for any taxes related to the movement of the stock price. Finally—not to end on a morbid note—if you pass away prior to vesting, you lose all rights to the RSUs.

Vesting Date: This is the date upon which the restricted units “convert” and the value is credited to you as fully taxable earned income. The vesting date is pre-defined when the RSUs are granted and is not changeable. Prior to vesting, you can elect what type of treatment you would like the shares to receive—more on that later. What is important for now is that you understand that the full amount of the shares’ value is no different than any other earned income.

Options For The Tax Treatment Of RSUs

As you can imagine, the tax treatment of RSUs can get complicated quickly, but that doesn’t mean you aren’t without options. When you reach your vesting date, you can:

- Sell for cash. If you like, you can sell all the shares and receive the proceeds, or

- Sell for taxes. With this option, enough shares are sold to pay the withholding taxes on the shares’ value. The remaining proceeds are then held in Amazon shares. When the shares come to you, the basis will be the price on the date of vesting…this is critical to note for future transactions.

To properly withhold so you are not shocked every April, a significant amount (perhaps upwards of 30% of the total amount) needs to come out for income taxes. Remember, this is like any other compensation, so the following might be due:

- Social Security taxes (6.2%)

- Medicare taxes (1.45%)

- Federal income taxes (up to 37% depending on your marginal tax bracket)

- State income taxes (depends on your state)

Suffice it to say, while you are watching your RSUs fluctuate in price, remember that they are only worth about 65-75% of the quoted value as income taxes are most definitely due upon vesting.

Now that we’ve covered the fine print, let’s look at a real-world example involving Amazon RSUs.

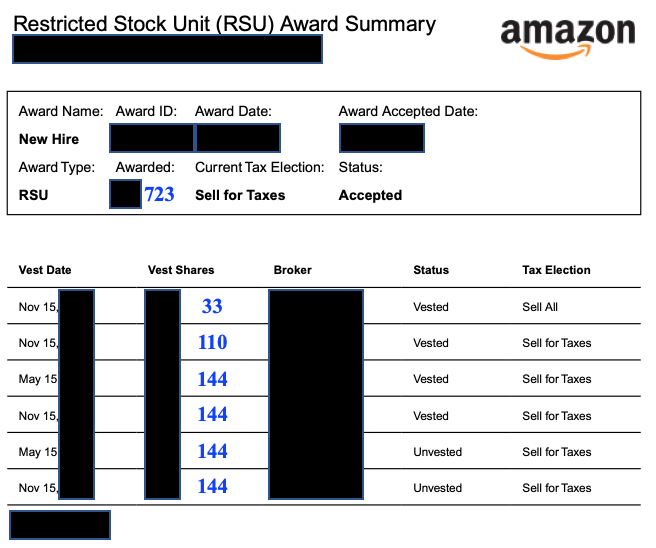

Restricted Stock Unit (RSU) Award Summary

Upon your hiring date, you will receive an RSU Award Summary similar to the redacted one below.

Recall, this excludes the base compensation, which is the cash part of one’s pay that is paid the traditional way via a regular paycheck.

There are a few items to note on this RSU Award Summary:

- The number of RSUs: In this case, 723.

- The vesting schedule: For new hires, the one-year vest is relatively small and grows each year thereafter. Subsequent grants vest faster.

- The status: As your shares vest, the status will update.

- The tax election: As stated before, you can “sell all” or “sell for taxes.”

Subsequent RSU Grants

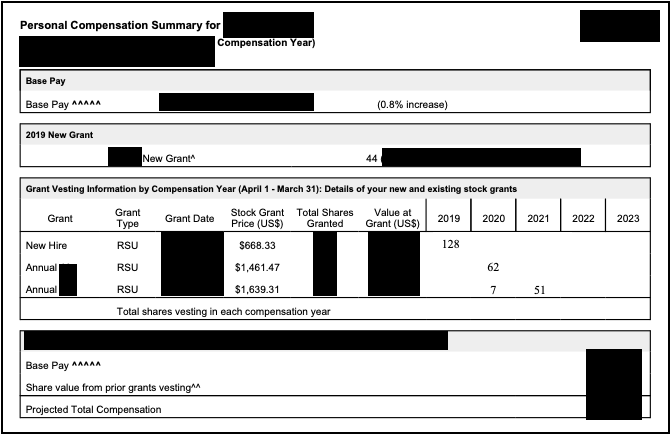

Each subsequent year, you will most likely receive additional RSU grants as part of your overall compensation. Below is another facsimile for an imagined person who has received three RSU grants—the initial hire grant plus two subsequent grants.

Here are some points to note:

- The grants accumulate: In this example, 128 shares vest in 2019, followed by 69 (62+7) in 2020, and then 51 in 2021. Subsequent grants would vest below these RSU grants.

- Because of the “parallel vesting,” the vests start to stack up, which you can see on the vesting schedule in the middle of the page.

- At the bottom of the statement, Amazon provides an estimate of the total compensation. While it is blacked out here, this estimate is simply the sum of your base pay plus your equity compensation.

What To Do When You Vest

Of course, each individual will have a different answer to the “What to do?” question. Here are some thoughts to consider

Create An Emergency Fund

Many people are seriously lacking an emergency reserve for unforeseen contingencies. When shares vest, a sizable amount of cash will become available. This is an opportunity to set aside an emergency fund once and for all.

Maximize Your 401(k) Contribution

If your base pay does not afford you the opportunity to maximize your Amazon 401(k) contribution, vesting is an opportunity to do so. The benefits, via both matching funds and possibly an income tax deduction, are very real and should be a strong consideration.

Invest In Education

Depending on your or your children’s higher education funding, you may want to consider contributing to a 529 account.

Build Your Savings

If for whatever reason you have not saved as much as you would have liked to, this is a golden opportunity to meaningfully contribute to your long-term savings and work toward your goals.

There are plenty of other options for how to use the money, but these are some ideas to get you thinking.

Other Considerations To Keep In Mind

Because Amazon stock has performed magnificently pretty much since it went public, there may be a strong bias to keep your money invested in Amazon stock. The conventional wisdom amongst most financial planners is to not have too high of a percentage of your investable assets in company stock. The reasoning has to do with concentration risk. While this is perhaps not as applicable to Amazon, the thinking is that you don't want to have all your savings invested in a company that also pays your salary. If something untoward were to happen, then both your job AND your savings could be jeopardized. Of course, the answer to this question is unique for each individual, thus it is wise to speak to a financial professional who can give you an outside opinion on what to do.

We Can Help

Hopefully this has provided you a thorough overview of your Restricted Stock Units (RSUs) and some possibilities of how they can work to your advantage. As I stated above, each situation is unique, so if you find yourself flummoxed about what to do, please do not hesitate to schedule a 30-minute introductory meeting or contact us at chris@resilientam.com or (901) 318-3423 so we can discuss your situation further.

About Christopher

Christopher Flis is founder and financial planner at Resilient Asset Management, a fee-only Registered Investment Advisor (RIA) based in Tennessee. Chris graduated from the United States Naval Academy with a bachelor’s degree in computer science, earned a Master of Science in Computer Science from the University of Minnesota, and attended flight school in Pensacola, FL, launching a fulfilling and distinguished military career. Chris spent 20 years in the Navy as an F/A-18 Strike Fighter Pilot, which included tours in Japan, Australia, and California, combat missions in all areas of the Persian Gulf and Afghanistan, and time spent as the Executive Officer of Naval Base Guam and Director of Navy Casualty in Millington, TN. When Christopher was ready to make a career change, he turned to a passion he held since high school when he attended a lecture on personal finance and started managing his own investments. He earned his Certified Financial PlannerTM (CFP®) designation and now combines his passions and experience by serving military, retired military, business owners, and retirees. Chris provides comprehensive, customized financial services, helping his clients overcome their challenges and take opportunities so they can achieve financial independence.

Chris lives in Downtown Memphis with his wife, Christine, and his son, Emerson. He is an avid runner and when he is not jogging for exercise, he is usually chasing his son around or walking his 3 dogs. To learn more about Chris, connect with him on LinkedIn.