At Resilient Asset Management, we provide three different service delivery models to meet your needs:

Ongoing Financial Planning:

Flat Fee

- Our preferred method of client engagement

- All Aspect Planning & Management

- Includes Investment Management

- Billed quarterly in arrears

- One time onboarding fee of $1,000

- Starts at $10,000 per year and is based on the complexity and time required to service your needs

Learn more

Portfolio Management:

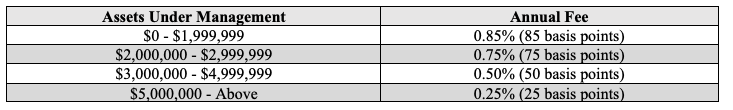

0.25-0.85% of assets under management

- No upfront cost

- Portfolio analysis and management

- At least one comprehensive review meeting per year

Learn more

Financial Second Opinion:

$250 per hour

- Work on what you need

- Estimated cost provided prior to start: billing at mid point and upon completion

Learn more

Ongoing Financial Planning

(includes Investment Management)

Our bedrock (and much-preferred) service method is to create an ongoing relationship where we assist our Clients in organizing and assessing their current financial situation, mapping out a comprehensive plan, and working together on an ongoing basis to achieve their long-term financial goals.

Throughout our relationship, we provide the following services and tools:

- Assistance with pre-retirement paperwork when leaving active duty

- Advising on initial filing of Veterans Administration (VA) Disability Claims

- Advising on Tricare for Military Retirees

- Data gathering and organization of financial documents and accounts

- Analysis of current financial situation and strategies to reach future goals

- Custom recommendations, including your Employer Retirement Plan

- Execution and development of implementation plans

- Streamlined to-do lists of your financial tasks

- Investment Management at the Firm’s Custodian (if desired) - there are no additional fees charged for Investment Management

- Ongoing monitoring, evaluation, and adjustment of your financial plan as needed

- At least one annual comprehensive review meeting

FEE | ASSET BASED

We charge a one-time Client Onboarding Fee of $1,000. Our fixed fee model starts from $10,000 per year and is based on the complexity, depth, breadth, and time required to service individual Client needs. The Client is billed quarterly in arrears and can pay via check, credit card, or by automatic debit from an investment account.

Portfolio Management

(does not include Financial Planning)

Some Clients already have a trusted team in place for all aspects of their finances, EXCEPT for portfolio management, which is an integral component of your retirement success strategies. Working in alignment with your other financial and legal professionals, the team at Resilient Asset Management can manage your investment portfolio on your behalf.

This is a separate and distinct standalone service offering than the Ongoing Financial Planning model described above.

Our Portfolio Management services include:

- Initial consultation

- Data gathering & risk tolerance assessment

- Portfolio analysis

- Delivery of recommended asset allocations and representative portfolio

- Asset transfer

- Portfolio allocation implementation

- Ongoing monitoring, evaluation, and rebalancing of your portfolio as needed

- At least one annual comprehensive review meeting

FEE | ASSET BASED

Fee is assessed depending on the amount of assets managed – please see the chart below. The Client is billed quarterly in arrears and can pay via check, credit card, or by automatic debit from an investment account.

Financial Second Opinion

For those looking for a “second set of eyes” to review their financial situation, Resilient Asset Management is happy to review, analyze, and provide recommended actions for Clients to consider and then implement themselves.

Our Second Opinion services include:

- Assistance with pre-retirement paperwork when leaving active duty

- Advising on initial filing of Veterans Administration (VA) Disability Claims

- Advising on Tricare for Military Retirees

- Initial consultation

- Data gathering and risk tolerance assessment

- Comprehensive analysis

- Custom recommendations for you to implement at your own discretion

FEE | HOURLY

For second opinions, we charge hourly billed at $250 per hour. The firm will provide an estimate of the number of hours and time frame required to complete the work. The Client is billed at the midpoint and upon completion of the second opinion and can pay via check or credit card.

Comprehensive Financial Assessment

For Clients who desire a complete review of their financial situation, we offer a thorough, multi-component planning engagement.

FEE | FIXED

For this arrangement, Clients are assessed a fixed fee with a minimum of $4,000.The total fee is dependent upon the planning complexity and the time required to deliver a completed financial plan.The Client is billed at the midpoint and upon completion of the second opinion and can pay via check or credit card.